sales tax on leased cars in ohio

While Ohios sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Like with any purchase the rules on when and how much sales tax youll.

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

This page describes the taxability of.

. Sales Tax 50000 - 5000 0575. For vehicles that are being rented or leased see see taxation of leases and rentals. Tax on leases is due up front but it can be rolled in to monthly payments.

2nd dealership says I will get a sales tax credit on the new purchase for the trade in value of my current vehicle theyd be taking. Herein How much is the sales tax on a leased car in Ohio. 1 2002 and there are no changes to the original lease agreement there is no sales tax due to the State of Ohio.

Ohio collects a 575 state sales tax rate on the purchase of all vehicles. If the lease was consummated in Ohio after Feb. Calculate Ohio Sales Tax Example.

For instance if your monthly payments reach 500 a month for three years and youre required to pay 7 percent sales tax on the vehicles entire value youll end up paying an extra 1260 in. Leases include future options to purchase or extend and agreements where the amount of consideration may be increased or decreased by reference to the amount realized upon the. Sales tax is a part of buying and leasing cars in states that charge it.

Ohio levies a sales and use tax on the retail sale lease and rental of personal property and the sale of selected services. 10k car 5k trade credit youll be taxed. In addition to taxes car purchases in ohio may be subject to other fees like registration title and plate fees.

Sales tax in Ohio is 575 and applies to all car purchaseseven used cars. At the very least youve probably already paid at least some of the sales tax on the car so its very unlikely that youll have to pay taxes on the total original price of the rented car. According to the sales tax manual you pay at least 575 sales tax rate when you buy a car in the state of Ohio.

In addition to sales tax youll also be. The lowest rate you can. In Ohio you pay tax on the total of monthly payments any Cap cost reduction cash down rebates etc.

Heres an explanation for. 1 2002 and there are no changes to the original lease agreement there is no sales tax due to the State of Ohio. Imagine that your monthly lease payment is 500 and your.

You need to pay taxes to the county after you. There are also county taxes that. Ohio collects a 575 state sales tax rate.

The way that the state of Ohio applies sales tax to car leases is. How Is Sales Tax Calculated on a Car Lease in Ohio. According to the Sales Tax Handbook you pay a minimum of 575 percent sales tax rate if you buy a car in the state of Ohio.

For vehicles that are being rented or leased see see taxation of leases and rentals. In addition Ohio counties and local transit.

How To Negotiate A Car Lease Credit Karma

Should You Lease Or Buy A Car Pros And Cons Of Leasing Vs Buying

Sample Car Lease Agreement With Explanations

Buy Used Cars For Sale Near Me Find Used Car Dealers Online

Best Lease Deals Incentives In October 2022 U S News

What S The Car Sales Tax In Each State Find The Best Car Price

Buy Here Pay Here Bad Credit Best Buy Motors Columbus Oh

Buy Here Pay Here Bad Credit Best Buy Motors Columbus Oh

Current Offers Lease Deals Specials Incentives Gmc

Badger Lease Auto Sales Inc Cars For Sale Milwaukee Wi Cargurus

Ohio S New Car Sales Tax Calculator Quick Guide

Uber Car Rental Best Rideshare Gig Car Rentals

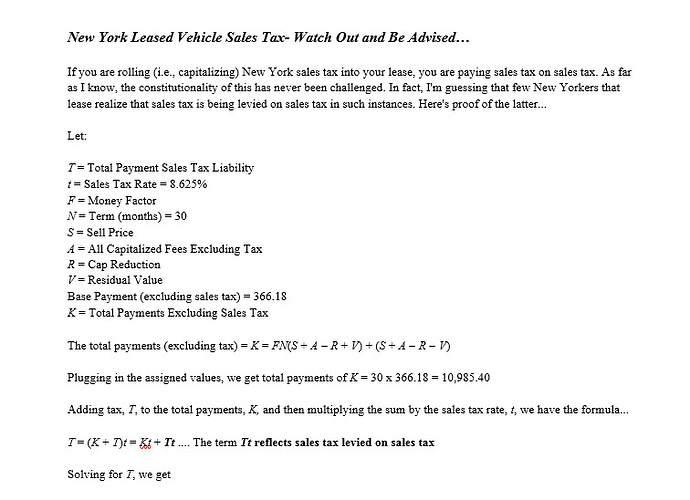

Taxes In New York Ask The Hackrs Forum Leasehackr

Off Lease Hi Res Stock Photography And Images Alamy

Do I Need To Pay Taxes On Private Sales Transactions Rocket Lawyer

If I Buy A Car In Another State Where Do I Pay Sales Tax

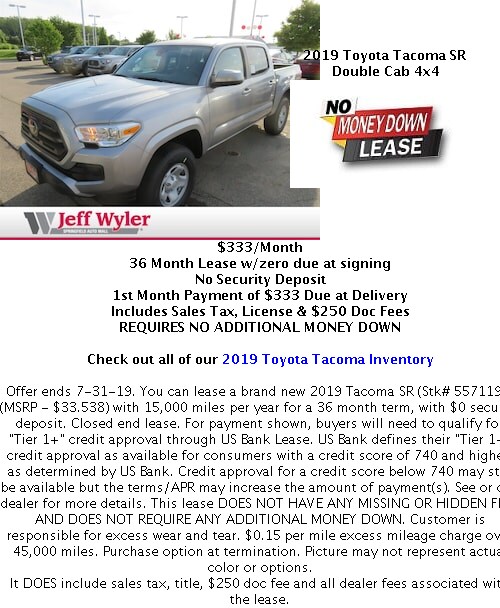

No Money Down Lease Jeff Wyler Springfield Toyota Serving Springfield Dayton Ohio Kentucky Indiana