bear trap stock term

Together they will arrange to sell a large amount of that coin at the same time. Essentially the bear trap is designed to encourage investors to buy at a higher price with the anticipation that during the upswing the unit price will exceed the rate that was paid for the shares.

Bear Trap Best Strategies To Profit From Short Squeezes

Bull traps act the same way as bear traps but in the opposite direction.

. Track your portfolio 24X7. MC30 is a curated basket of 30 investment-worthy. While not an indicator a bear trap is a technical trend or pattern that can be seen when the price movement of a stock or any financial security signals a false reversal from a downward to an upward trend.

February 2 2022 139 PM. Stock market trend shows bear trap relief rally rather than bottom strategist says. It can also occur when a stock that looks poised to begin falling unexpectedly maintains an upward trend.

However in this context the term is used to describe both the technique and the specific technical indication of a reversal in a market downtrend. Invest in Direct Mutual Funds New Fund Offer NFO Discover 5000 schemes. A bull trap may also refer to a whipsaw pattern.

Spotting bear traps help us avoid them. Bear traps on stocks can also be found on intraday charts. What Is Bear Trap in Trading.

It consists of creating a false signal in the market indicating that an asset is going to start losing its value. The opposite equivalent of bear traps are the bull traps. A bear trap is a trading term used to describe market situations that indicate a downturn in prices but actually leads to higher prices.

When the performance of an index stock or other financial instrument incorrectly signals a reversal of a rising price trend a technical pattern that occurs this is known as a bear trap. URGENT BULL OR BEAR TRAP ON STOCK MARKET EARNINGS FB SNAP AMZN WISH. A bear trap occurs when a stock or another security that is losing value suddenly reverses course and begins to gain value instead.

Bear traps could easily be hedged simply by putting stop loss orders on your trades. This scenario traps traders or investors who act on the buy signal. Log in or sign up to leave a comment.

The attempted manipulation of a specific cryptocurrencys price based on the coordinated activity of a group of traders. Bearish investors who have shorted or bet against that stock may experience losses. If you look at the bigger picture and.

It is a term in the stock trading where the expected downwards movement of share prices immediately reverses upwards. The move traps traders or investors that acted on the buy signal and generates losses on resulting long positions. According to Investopedia a bear trap is.

It may also be referred to as a. What Is a Bear TrapA bear trap will generally involve a number of traders who have significant combined holdings of a cryptocurrency. Download 1200 Royalty Free Bear Trap Vector Images.

A Bear Trap is a technical pattern that occurs when the performance of a stock or an index incorrectly signals a reversal of a. When shares in an uptrend suddenly fall a bear trap often follows. The best selection of Royalty Free Bear Trap Vector Art Graphics and Stock Illustrations.

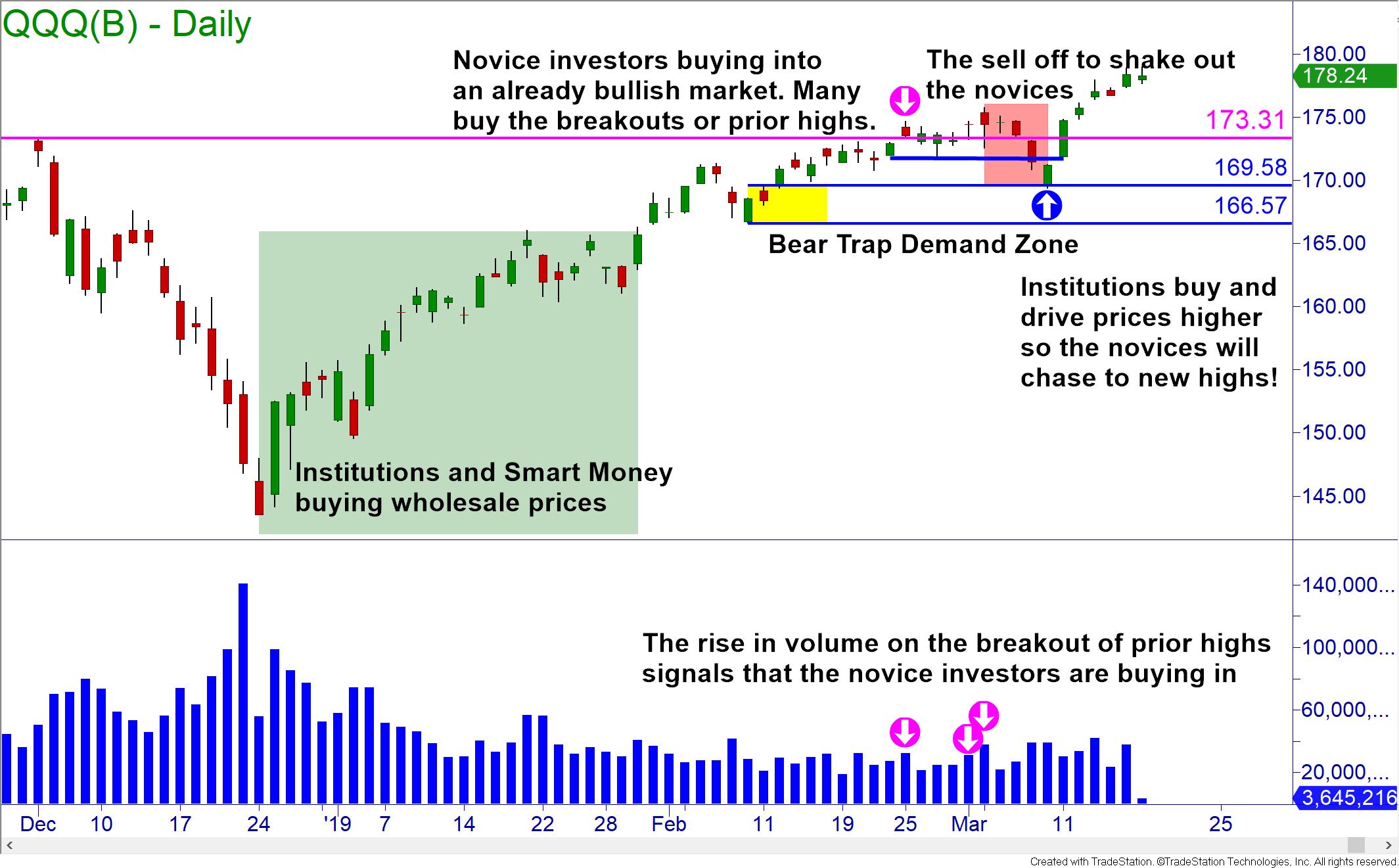

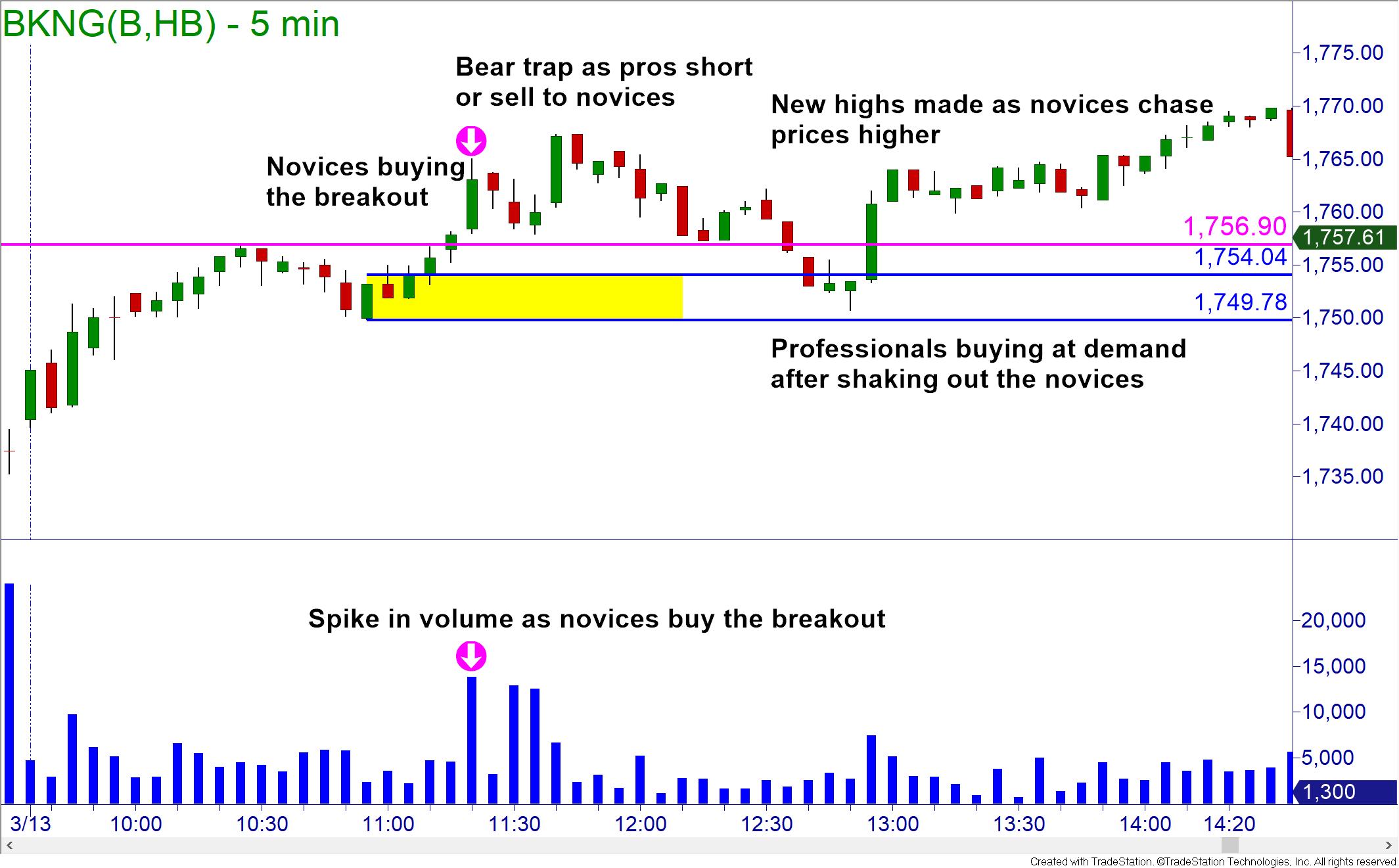

Invest In MC 30. As a result they generate losses from the long positions they establish. A Bear Trap in terms of trading is a strategy that institutions use to take advantage of the young traders that dont have the insight to recognise when they are being played.

Rather they should adopt a long-term horizon and add quality stocks during significant dips he said. This phenomenon results from short selling or overleveraging by a brokerage firm. The same setup is usually observed prices breaking out to fresh highs where institutions will sell or short sell to the novices buying.

A bear trap has the potential for creating a great deal of revenue for the investor. The opposite of a bull trap is. Markets in a bear trap investors lose Rs 10 lakh crore of wealth in 2 days.

The reversal occurs after a convincing rally that breaks a prior support level. A bear market rally is the term for a temporary increase in stock market prices that occurs during a bear market. Finocent August 22 2021 Hence a false reversal of.

It refers to a declining trend in a stock index or other security. The value of the coin then rebounds and the trap setters have made a profitBear traps originated on the stock market. Bear trap An accumulation of shares being sold short by bears trying to drive down the price of a stock.

It is a popularly used term in the market when the market indicates a downturn at first but quickly picks up and goes into steady growth. Posted by 7 minutes ago. A bull trap is a false signal.

This attracts many investors in buying. The bear trap occurs when the bears find they must repurchase the shares from an individual or a group at an artificial price determined by the seller.

What Is A Bear Trap On The Stock Market

What Is A Bear Trap On The Stock Market

What Is A Bear Trap On The Stock Market Fx Leaders

Bear Trap Explained For Beginners Warrior Trading

Bear Trap Best Strategies To Profit From Short Squeezes

Bear Trap Stock Trading Definition Example How It Works

Bear Trap Best Strategies To Profit From Short Squeezes

Don T Get Caught In A Bull Trap Tips To Avoid Getti Ticker Tape

What Is A Bull Trap In Trading And How To Avoid It Ig En

Bear Trap Best Strategies To Profit From Short Squeezes

The Great Bear Trap Bull Trap Seeking Alpha

What Is A Bear Trap On The Stock Market Fx Leaders

Bear Trap Best Strategies To Profit From Short Squeezes

Bear Trap Explained For Beginners Warrior Trading

The Great Bear Trap Bull Trap Seeking Alpha

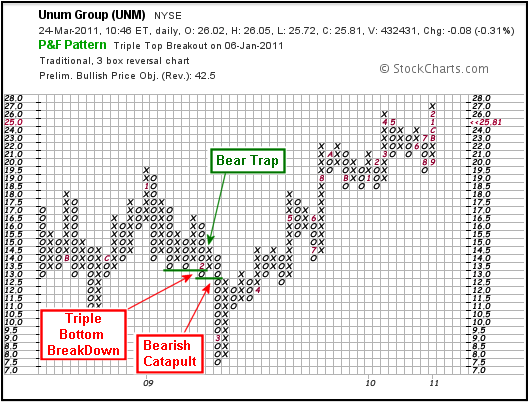

P F Bull Bear Traps Chartschool

:max_bytes(150000):strip_icc()/Clipboard01-c2c4a2d12c05468184b82358f12a1af5.jpg)